Key Takeaways

- W.P. Carey is getting out of the office real estate market after the pandemic-related rise in “work from home” impacted demand.

- The company will spin off some of its office properties and sell the rest.

- CEO Jason Fox said the move will help the firm lower its cost of capital and help create long-term value for shareholders.

The collapse in demand for commercial office space after the pandemic-related rise in “work from home” (WFH) has led W.P. Carey (WPC) to exit that business segment. The real estate investor announced that its board has unanimously agreed to exit the market by spinning off or selling all the office assets in its portfolio.

The plan calls for 59 of the properties to be placed into Net Lease Office Properties (NLOP), a separate, publicly-traded real estate investment trust (REIT), with the remaining 87 put up for sale. As of June 30, W.P. Carey had 1,475 net lease properties and 85 self-storage facilities.

The spinoff is scheduled to occur on or around November 1, while the sale is set for January 2024.

CEO Jason Fox said by taking these steps, W.P. Carey will be “enhancing the overall quality of our portfolio, improving the quality and stability of our earnings, and incrementally benefiting our credit profile.” He added that the company will achieve a lower cost of capital and be better positioned to create long-term value for investors.

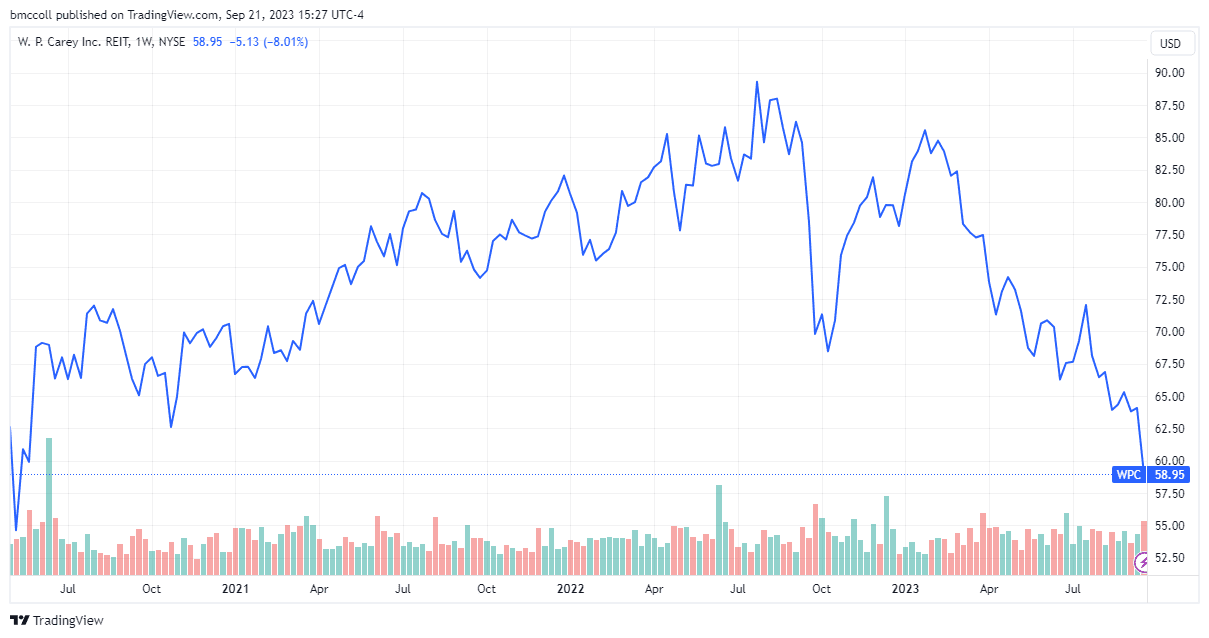

Shares of W.P. Carey tumbled close to 8% on Thursday following the news, falling to their lowest level in more than three years.

TradingView

This post was originally published on this site be sure to check out more of their content.