Key Takeaways

- Starbucks’ sales fell by 4% in Q2 2024.

- The share price reached a 21-month low after a disappointing quarterly earnings report.

- The coffee company has made a downward revision of annual sales forecasts after closing its NFT program.

Starbucks reported disappointing second-quarter earnings for fiscal 2024. The company’s financial distress comes just weeks after it discontinued its NFT program, Starbucks Odyssey. The timing could suggest a significant downturn in consumer demand, highlighting sales challenges for the global coffee giant.

Starbucks’ Financial Performance Overview

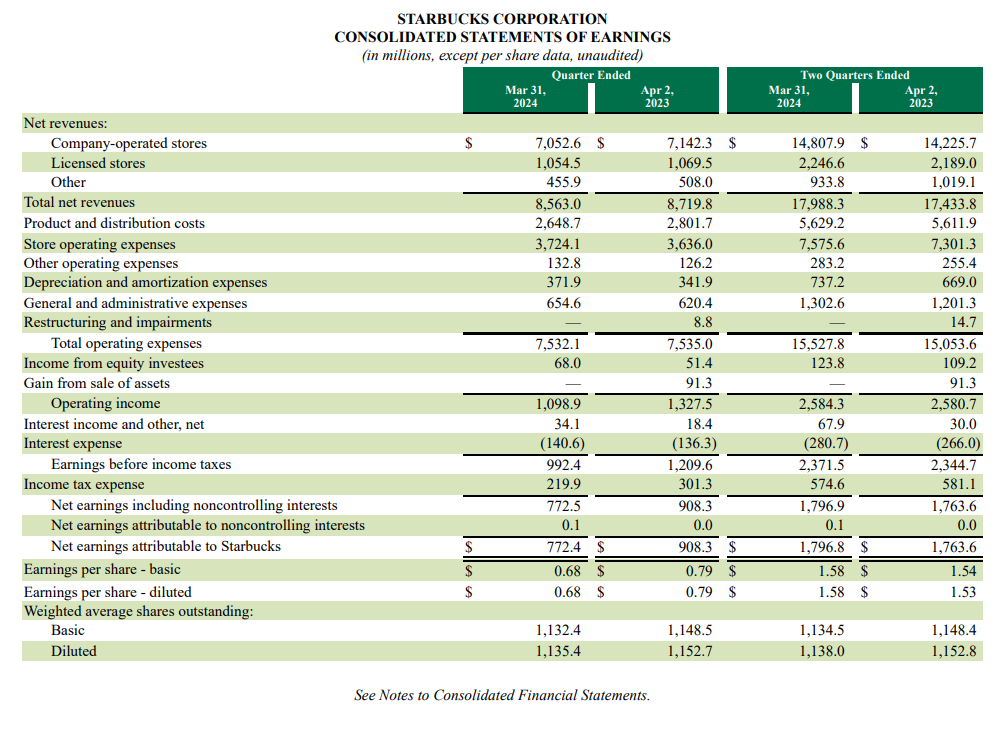

In Q2 2024, Starbucks reported a challenging operating environment with consolidated net revenues falling by 2% to $8.6b. Starbucks reported both GAAP and non-GAAP accounting methods to report earnings per share (EPS) of $0.68. These figures show a decline compared to the previous year, with GAAP earnings down 14% and non-GAAP earnings down 8%.

There was a 4% decline in global comparable store sales, primarily driven by a 6% decrease in transaction volume, though somewhat maintained by a 2% increase in average ticket prices.

International markets saw a 6% decrease in comparable store sales, heavily impacted by an 11% decline in China. The Starbucks Rewards program in the US saw growth, reaching 32.8m active members, marking a 6% increase from 2023.

Starbucks’ operating margins showed contraction. The GAAP operating margin decreased by 240 basis points to 12.8%.CEO Laxman Narasimhan commented on the quarter’s challenges and the company’s response, stating, “In a highly challenged environment, this quarter’s results do not reflect the power of our brand, our capabilities, or the opportunities ahead.” He emphasized that the results were below expectations but reaffirmed the company’s long-term strategy and operational adjustments.

But, in the first half of fiscal 2024, Starbucks saw an increase in net cash provided by operating activities, reaching $2.9b, up from $2.4b the previous year.

However, the company also faced higher capital expenditures and a decrease in asset sale proceeds, which led to a significant increase in net cash used in both investing ($1.3 billion) and financing activities ($2.4 billion).

Starbucks Odyssey NFT Program

Launched in September 2022, the Starbucks Odyssey was an ambitious extension of the Starbucks Rewards program. It wanted to utilize Web3 technology to offer unique benefits through NFTs called ‘Journey Stamps‘.

The program was recently discontinued in March 2024, just before the release of the Q2 earnings report.

Starbucks said in the March release that it is ending the Odyssey program to prepare for future innovations. The announcement also coincided with a weakness in the NFT market with trading volumes on a decline .

The company’s financial overview and ending of rewards problem state that consumer demand for Starbucks has taken a hit.

Meanwhile, Starbucks’ stock price tumbled to a 21-month low, reflecting investors’ concerns. The company has cut its annual sales forecast with an adjustment to weak consumer demand.

In response to these challenges, Starbucks’ forward-looking statement underlines customer attraction and retention. The company is focusing on operational efficiency and market adaptation to navigate through the economic headwinds.

Consumer Demand Needs to Pick Up

Starbucks stock is weak and all eyes are on H2 2024 after its disappointing Q2 2024 financial results and the cessation of its Starbucks Odyssey NFT program. The financials may reflect deeper issues in consumer demand both in the US and key international markets like China. The company’s ability to navigate these challenges will be essential for stabilizing and potentially enhancing its sales growth.

Moving forward, Starbucks will have to strategically balance innovation with core business efficiencies to rejuvenate demand and sustain growth. The company’s adjustments in response to a shifting market, weak NFT market, and consumer demand will determine its capacity to maintain profitability and global expansion.

Was this Article helpful?