As an old school traditionalist who prefers using her notebook and pencil to write, even long chapters of postdoctoral research, the parallel technology heavy world of artificial intelligence, cryptocurrency and non-fungible tokens (NFT) has alwaysfascinated me. Simply reading about these discoveries and trends makes me feel like I am part of a blockbuster science fiction film.

In recent years, NFTs have created quite the hype with the demographic of art buyers expanding as their demand surged. However, digital art has simply been aprogression, evolution and diversification of art. Recall the late 90s and early 2000s where the ‘Paint’ application on a Windows PC was perhaps the most exciting and fascinating aspect of a computer for the novice. Ever since that era, art in the digital realm has only grown and expanded. Better technology enticed the user to be more creative and experiment with various styles, colours and designs. But the ease of saving a digital work of art or simply downloading it from a search engine led to their being no clear ownership or copyright.

The entry of a ‘Non Fungible Token’ has essentially taken care of this problem, by providing the digital art work with a unique code, making it authentic and unique. It cannot be duplicated. NFTs have allowed ownership of digital art, and this has helped it to become a tradable, digital asset.

So while I do understand the excitement, the skyrocketing prices have often left me bewildered and at times disappointed. Does creativity take a backseat when the transactionary nature supersedes human emotion and skill?

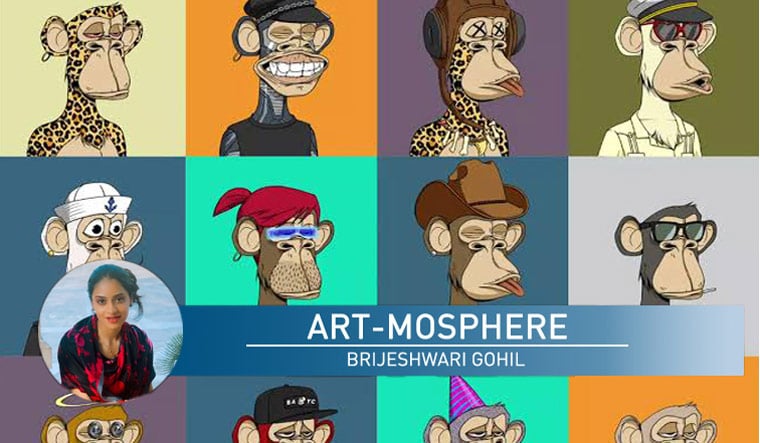

For example, the Bored Ape series of works had international celebrities like Justin Bieber and Paris Hilton purchasing NFTs. While being valued for over a million dollars in 2022, these unique works of art, depicting, well, ‘Bored Apes’; are now worth around a mere $50,000. Even auction houses successfully monetised on the NFT trend with the 2021 Christie’s auction having the digital work, ‘Everydays: the First 5000 days’ fetching $69.3 million.

Where does India and Indian art stand today in this volatile NFT world? When theNFT trend was at its all time high, Indian celebrities and influencers were jumping onto the bandwagon and creating their own collections as well as purchasing digitalworks as investments.

For example, the doyen of Indian cinema, Amitabh Bachchan sold his father’s poetry renditions as well as art in the form of NFT for a whopping $966,000. Designer Manish Malhotra became the first Indian designer to sell an exclusive set of his fashion sketches in the form of NFT. Even Indian auction houses and artist estates curated their own NFT auctions and sales.

However, the short-lived market in India has never really managed to grow leaps and bounds. It could be the global downfall of the NFT market, which may have contributed to this demise or the lack of transactional and trading know-how.

As a country, India is now getting some clarity where taxation and the legal nuances of NFTs are concerned. Given an NFT can only be bought with cryptocurrencies, there were several hurdles for an NFT buyer and seller. Many of these have been resolved with NFTs now coming under ‘Virtual Digital Assets’.

Presently the Indian taxpayer is liable to pay 30 per cent tax on the digital assets. A number of education institutes are also including courses on creating NFTs stating that their students would have a platform to explore their creativity and also learn about the multilayered, ever evolving and fascinating digital world.

However, April 2024’s global data revealed that within a month, sales have decreased by 31.26 per cent and purchasers of NFTs have dropped by 51.88 per cent. This comes as a result of several concerns including regulatory uncertainty and IP infringement. Even the celebrity favourite Yuga Labs responsible for the sensational, once-million-dollar-worth Bored Ape series is restructuring and downsizing their team.

To add to this, Paypal just released that it would not be supporting sales of NFTs in its buyer and seller protection programme. The uncertainty around fulfilling an order and the scams taking place are just too risky to continue offering such protections and aid.

So is this really the right time to be spotlighting NFTs in India? All markets right from the stock market to housing have had cycles, they have crashed, bounced back, again combusted but eventually found their bearings, which gives hope to NFTs.

The digital world is a bizarre, unpredictable place filled with now acceptable words such as ‘rizz’, so you never know when someone may find a ‘Bored Ape’ interesting.