The real estate sector in Gujarat witnessed a significant shift in the wake of the Covid-19 pandemic. The demand for residential properties skyrocketed, but the commercial real estate market took a significant hit.

The new supply of commercial real estate has plummeted by a staggering 80% over the past five years. The pandemic-induced lockdowns have had a detrimen tal effect on the retail and office space markets, making developers hesitant to initiate commercial projects at the same pace as before the outbreak. As a result, the number of new comme rcial property launches has hit an all-time low, setting a historic precedent in the industry.

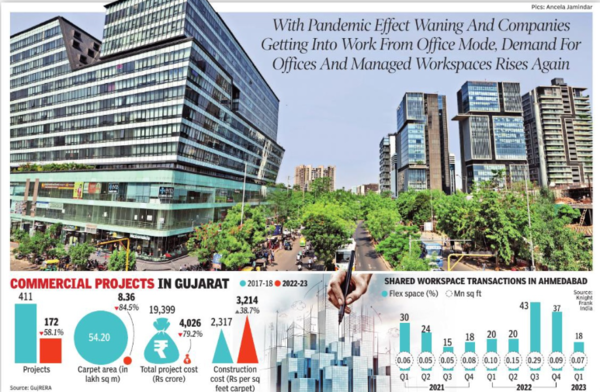

In 2017-18, Gujarat saw 411 commercial projects registered with the Gujarat Real Estate Regul atory Authority (GujRERA), with a combined carpet area of 54. 20 lakh sq m. However, this number has steadily decreased over the years. In 2021-22, only 241 commercial projects with a carpet ar

ea of 12. 64 lakh sq m were registered, and the numbers dropped to 172 projects with a total of 8. 36 lakh sq m of carpet area in 2022-23. The total commercial property project cost was Rs 19,399 crore in 2017-18, which reduced by 79. 2% to Rs 4,026 crore in 2022-23.

GujRERA data suggests Ahmedabad alone contributes almost 40% to Gujarat’s commer cial real estate sector as investors f r o m across the state invest in the city.

The commercial property demand in Ahmedabad is rising because rental yields have improved in various parts of the city.

Ahmedabad registered 164 commercial property projects with a total carpet area of 21. 68 lakh sq m in 2017-18. This dropped to 69 projects and 3. 34 la kh sq m carpet area last year.

“This shows that the supply of new commercial projects is very low. However, the demand is picking up strongly, so rates of commercial prope rties will remain firm for the next few years,” said an Ahmedabad developer.

Explaining the trend, Shekhar Patel, president-elect of

Credai National, said, “There was a reduction in commercial projects after Covid struck. Against 2017-18, supply was reduced by almost 80%, which has led to a shortage of new Grade A office spaces in Ahmedabad. ”

Demand to drive project launches

Interestingly, the demand for grade-A commercial spaces has increased sharply over the past few months, driven by forays of new companies into Gujarat and a thriving startup ecosystem.

Experts believe 2023-24 will see a significant increase in the new commercial projects launched.

“Ahmedabad and Gujarat will reap maximum benefits out of projects like GIFT City, Dholera Special Investment Region (DSIR), Delhi Mumbai Industrial Corridor (DMIC), as well as the bullet train project. Connectivity to Mumbai and Delhi will improve, and all these projects will inc rease demand for commercial properties,” Patel further explained.

Yet another factor propelling good demand for commercial properties now is the backto-office working mode.

“The deman d for retail properties has gone up too. At present, there is nearly zero inventory in good commercial projects due to limited supply. Therefore, the city will see new comm ercial projects launched in 2023-24. We believe Grade A environment-friendly and sustainable buildings with green building certification will witness sales. Areas including SG Road, Sindhu Bhavan Road, Ambli-Bopal and Vaishnodevi Circle will see high office space demand from IT, finance, consulting, and co-working space companies,” Patel added.

Jay Deliwala, a property consultant, s aid, “Ahmedabad saw strong demand for office space and retail space between 2011 and 2019. However, the lockdown brought the work-from-home concept. On the other hand, retail outlets remained shut for a longtime. Several lease deals were cancelled, and investors were concerned. It was not a favourable situation for developers to launch new commercial projects. However, the demand has risen over the past few months, and new projects have been launched in good numbers. Rental yields have improved in quality office and retail space, drawing investors back. ”

Covid lockdown changed the market scenario, and many developers launched residential projects instead of commercial ones.

Rajesh Vaswani, director of Ven us Group, said, “We wanted to develop a commercial project behind Rajpath Club. However, the Covid lockdown changed the scenario as the retail segment was not performing, and offices were closed due to work from home. On

the other hand, the demand for luxury residences rose, so we decided to develop a residential project at the same site. ”

Co-working spaces coveted

With the hybrid work model becoming widely accepted by most companies in the post-pandemic world, shared workspaces are in an expansion mode inentrepreneurial Gujarat. While the demand for commercial real estate slowed postCovid, co-working spaces altered the dynamics in a big way, with flexible and managed office players bringing value deals for occupiers.

“Managed office pl ayers in Gujarat have a good hold on the developers to bring value deals for occupiers. It is expected that this sector will continue to show strong resilience in the market,” said B albir Singh, executive director of Knight Frank India.

Several players are bullish on expansions and have remained so over the past year.

Umesh Uttamchandani, the co-fou nder of DevX, said, “Last year was a phenomenal year for managed working spaces. Pan India, the market has grown nearly fourfold. In Gujarat, 78% of leasing occurred with managed office space players. We have signed up for a 3. 5 lakh square feet standalone asset and 1 lakh square feet in GIFT IFSC. The demand is largely driven by IT SMEs in addition to st artups and even global players who are looking to set up offices in India. ”

Interestingly, the adoption of managed office spaces is also growing in Tier-II cities.

Harshil Khajanchi, the founder of Paragraph Co-Working Space, said, “We have seen good demand for coworking and managed office spaces after Covid. Several MNCs are now looking for co-working or managed offices in Ahmedabad. We curren tly have a total of 60,000 sq feet of co-working and managed office space and have recently added another 30,000 sq feet in Nehrunagar. ”

This post was originally published on this site be sure to check out more of their content.