Zephyr18

Dear Baron Real Estate Income Fund Shareholder:

Performance

We are pleased to report that Consuelo Mack, a highly respected and distinguished business journalist, recently interviewed us and profiled Baron Real Estate Fund® in a TV interview for Consuelo Mack WealthTrack, that is set to broadcast in two half-hour segments on April 19, 2024 and April 26, 2024. In the interview, we discussed several topics that we believe are relevant to the Baron Real Estate Income Fund® (the Fund). We will attach a link to the interviews on our Baron website homepage at baronfunds.com in the “News & Events” section at a later date.

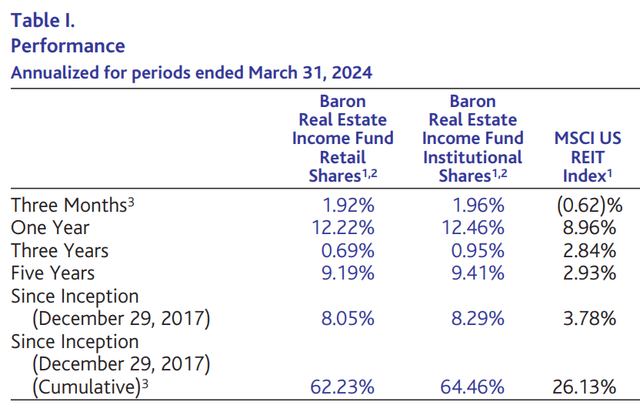

The Fund increased 1.96% (Institutional Shares) in the first quarter of 2024, outperforming the MSCI US REIT Index (the REIT Index), which declined 0.62%.

Since inception on December 29, 2017, through March 31, 2024, the Fund’s cumulative return of 64.46% was more than double that of the REIT Index, which increased 26.13%.

As of March 31, 2024, the Fund has received high rankings from Morningstar for its performance:

- Top 9% real estate fund ranking for its 1-year performance

- #4 ranked real estate fund for its 5-year performance period

- #4 ranked real estate fund ranking since the Fund’s inception on December 29, 2017

We will address the following topics in this letter:

- Our current top-of-mind thoughts

- Portfolio composition and key investment themes

- Top contributors and detractors to performance

- Recent activity

- Concluding thoughts on the prospects for real estate and the Fund

|

As of 3/31/2024, the Morningstar Real Estate Category consisted of 250, 236, 217, and 224 share classes for the 1-, 3-, 5-year, and since inception (12/29/2017) periods. Morningstar ranked Baron Real Estate Income Fund Institutional Share Class in the 9th, 78th, 2nd, and 2nd percentiles for the 1-, 3-, 5-year, and since inception periods, respectively. On an absolute basis, Morningstar ranked Baron Real Estate Income Fund Institutional Share Class as the 19th, 195th, 4th, and 4th best performing share class in its Category, for the 1-, 3-, 5-year, and since inception periods, respectively. As of 3/31/2024, Morningstar ranked Baron Real Estate Income Fund R6 Share Class in the 9th, 78th, 2nd, and 2nd percentiles for the 1-, 3-, 5-year, and since inception periods, respectively. On an absolute basis, Morningstar ranked Baron Real Estate Income Fund R6 Share Class as the 18th, 194th, 5th, and 5th best performing share class in its Category for the 1-, 3-, 5-year, and since inception periods, respectively. Morningstar calculates the Morningstar Real Estate Category Average performance and rankings using its Fractional Weighting methodology. Morningstar rankings are based on total returns and do not include sales charges. Total returns do account for management, administrative, and 12b-1 fees and other costs automatically deducted from fund assets. Since inception rankings include all share classes of funds in the Morningstar Real Estate Category. Performance for all share classes date back to the inception date of the oldest share class of each fund based on Morningstar’s performance calculation methodology. © 2024 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely; and (4) does not constitute advice of any kind, whether investment, tax, legal or otherwise. User is solely responsible for ensuring that any use of this information complies with all laws, regulations and restrictions applicable to it. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. MORNINGSTAR IS NOT RESPONSIBLE FOR ANY DELETION, DAMAGE, LOSS OR FAILURE TO STORE ANY PRODUCT OUTPUT, COMPANY CONTENT OR OTHER CONTENT. |

Our Current Top-Of-Mind Thoughts

Our current top-of-mind thoughts are as follows:

We remain optimistic about the prospects for the stock market.

- As noted in our year-end 2023 shareholder letter, we are sanguine about the prospects for the stock market because our research continues to lead us to believe that corporate earnings are likely to continue to grow, and a severe economic slowdown is unlikely to materialize. We continue to expect ongoing disinflation (albeit at a slower pace), and an eventual global pivot in monetary policy that will result in interest rate cuts and welcome relief for consumers and corporations. We see the potential for an improvement in company valuations driven by an easing in financial conditions and better-than- feared economic and corporate growth.

We agree with Blackstone’s optimistic perspective on the prospects for real estate.

- In March, Bloomberg interviewed Jon Gray, President & Chief Operating Officer of Blackstone, and Nadeem Meghji, Global Co-Head of Real Estate at Blackstone, who discussed their optimism for real estate. We concur with their views.

Jon Gray:

- “The perception is so negative and yet the value decline has occurred, so when you get into this bottoming period that’s when you want to move.”

- “As investors, sometimes, one of the risks is that you miss it by being overly cautious, and I think now is probably a good time

Nadeem Meghji:

- “What we see is a generational investing opportunity, buying opportunity, while others are looking in the rearview mirror. And what we believe is happening is that values are bottoming.”

We remain steadfast in our view that a commercial real estate crisis is not on the horizon.

- Ever since the collapse of Silicon Valley Bank one year ago, we have consistently expressed our view that forecasts of widespread distress in commercial real estate are sensationalized and unlikely to materialize.

- We continue to believe that the likelihood of a commercial real estate crisis is low for the following reasons:

- Real estate operating fundamentals are, in most cases, performing well

- New construction activity has been and is expected to remain low. The dearth of new real estate construction activity compares favorably with prior real estate cycles when overbuilding of real estate contributed to a deterioration in real estate business prospects

- Most balance sheets are in strong shape

- The banking system is well capitalized, with ample liquidity

- We believe future loan defaults will be mostly isolated to class B and C office buildings

- A Federal Reserve (the Fed) put(e.g., lowering interest rates) could mitigate headwinds

We continue to identify compelling investment opportunities across several REITs (in particular, secular growth REITs and short-lease duration REITs with pricing power) and non-REIT real estate companies.

We have been busy meeting with real estate executives and the conclusions from our diligence are encouraging.

- In the first three months of 2024, we traveled to meet with the CEOs of several REIT and non-REIT real estate companies

-

Our team continues to speak to a broad swath of real estate companies-both owned and not owned-a few times each quarter to make sure our research remains current. Broadly, we remain comforted by what we continue to learn from most real estate management teams regarding current business trends and business prospects

-

Our corporate relationships and access to senior level real estate management teams are critical elements that contribute to competitive advantages for our real estate business versus many of our peers

|

Performance listed in the above table is net of annual operating expenses. The gross annual expense ratio for the Retail Shares and Institutional Shares as of December 31, 2023, was 1.32% and 0.96%, respectively, but the net annual expense ratio was 1.05% and 0.80% (net of the Adviser’s fee waivers), respectively. The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. The Adviser waives and/ or reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month end, visit Baron Funds – Asset Management for Growth Equity Investments or call 1-800-99-BARON. 1 The MSCI US REIT Index Net (USD) is a free float-adjusted market capitalization index that measures the performance of all equity REITs in the US equity market, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The index and the Fund include reinvestment of dividends, net of withholding taxes, which positively impact the performance results. The index is unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. 2 The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. 3 Not annualized. |

The valuations of several real estate-related companies are compelling.

- A good portion of public real estate-including both REITs and non-REIT real estate-related companies-is attractively valued relative to historical averages

- Currently, several public REITs and non-REIT real estate-related securities are meaningfully discounted relative to private real estate alternatives

We continue to see a strong backdrop for real estate securities-REITs and non-REIT real estate-related companies-in 2024:

- Several public real estate companies have underperformed the S&P 500 Index since 2019, in part due to the lingering impacts from COVID-19, the aggressive Fed interest rate tightening cycle, and more recently, the overhang of the commercial real estate crisis narrative which we continue to believe is unlikely to materialize

- The global pivot in monetary policy-from restrictive to accommodative-has historically been bullish for real estate, though the timing of the pivot is uncertain

- We expect a modest decline in interest rates and tighter credit spreads, which will support real estate valuations, reduce the weight of debt refinancings, and reignite the transaction market

- We see attractive demand versus supply prospects. Vacancies are low, rents and home prices continue to increase albeit at a slower rate, and competitive new construction is muted for most commercial and residential sectors and geographic markets over the next several years

- Most balance sheets are in strong shape

- Several public real estate companies are cheap relative to historical averages and relative to private real estate alternatives

- Substantial private capital is in pursuit of public real estate because private funds can buy quality public real estate at a discount relative to private real estate

- Generalist investors who have been underweight real estate may increase allocations and real estate fund flows may turn positive given the above considerations

We continue to believe the long-term case for real estate remains compelling, as real estate tends to provide:

- Partial inflation protection

- Diversification and low correlation to equities/bonds

- Strong historical long-term returns relative to most investment alternatives

Portfolio Composition And Key Investment Themes

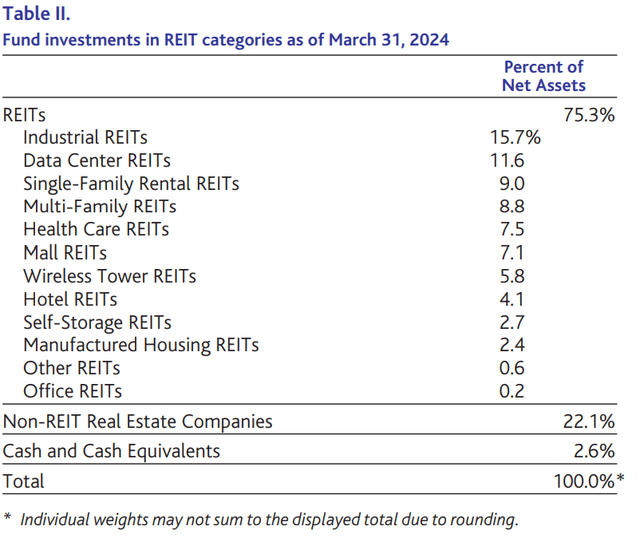

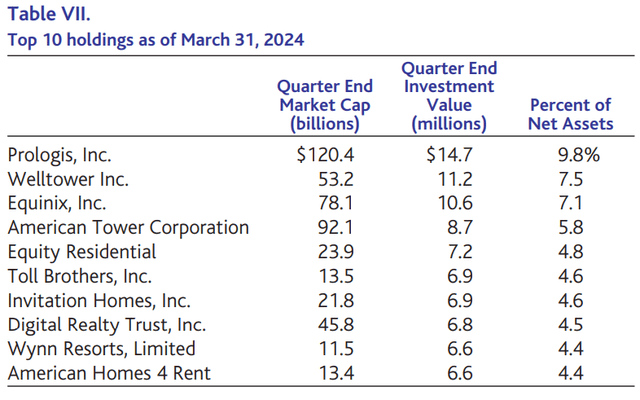

As of March 31, 2024, we invested the Fund’s net assets as follows: REITs (75.3%), non-REIT real estate companies (22.1%), and cash (2.6%). We currently have investments in 12 REIT categories. Our exposure to REIT and non-REIT real estate categories is based on our research and assessment of opportunities in each category on a bottom-up basis (See Table II below).

REITs

Business fundamentals and prospects for many REITs remain solid although, in most cases, growth is slowing due to debt refinancing headwinds, a moderation in organic growth (occupancy, rent and/or expense pressures), reduced investment activity (acquisitions and development), and, in a few select instances, the impacts from transitory oversupplied conditions. Most REITs enjoy occupancy levels of more than 90% with modest new competitive supply forecasted in the next few years due to elevated construction costs and contracting credit availability for new construction. Balance sheets are in good shape. Several REITs have inflation-protection characteristics. Many REITs have contracted cash flows that provide a high degree of visibility to near-term earnings growth and dividends. Dividend yields are generally well covered by cash flows and are growing.

REIT valuations are attractive on an absolute basis relative to history and relative to private market valuations, but not relative to fixed income alternatives. If economic growth contracts and evolves into no worse than a mild recession and the path of interest rates peaks at levels not much higher than current rates, we believe the shares of certain REITs may begin to perform relatively well. Should long-term interest rates begin to decline and credit spreads compress, REIT return prospects may also benefit from an improvement in valuations as valuation multiples expand (e.g., capitalization rates compress).

We continue to prioritize secular growth REITs and short-lease duration REITs with pricing power:

- Secular growth REITs: Our long-term focus remains on real estate companies that benefit from secular tailwinds where cash-flow growth tends to be durable and less sensitive to a slowdown in the economy. Examples include our investments in industrial, data center, wireless tower, and life science REITs. As of March 31, 2024, secular growth REITs represented 33.6% of the Fund’s net assets.

- Short-lease duration REITs with pricing power: We have continued to emphasize REITs that are able to raise rents on a regular basis to combat inflation’s impact on their businesses. Examples include our investments in single-family rental, multi-family, hotel, self-storage, manufactured housing REITs. As of March 31, 2024, short-lease duration real estate companies represented approximately 27.0% of the Fund’s net assets.

Secular growth REITs (33.6% of the Fund’s net assets)

Industrial REITs (15.7%): Though we are a bit cautious near term due to expectations that demand will continue to normalize to pre-pandemic levels (elongated corporate decision-making), anticipated elevated supply deliveries in the first half of 2024, and expectations of moderating rent growth in certain geographic markets, we remain optimistic about the long-term prospects for industrial REITs.

With industrial vacancies at approximately 5%; moderating new supply in the second half of 2024; rents on in-place leases more than 50% below market; and multi-faceted secular demand drivers including the ongoing growth in e-commerce, companies’ seeking to improve inventory supply-chain resiliency by carrying more inventory (shift from just in time to just in case inventory), and on-shoring, we believe our investments in industrial warehouse REITs Prologis, Inc. (PLD), Rexford Industrial Realty, Inc. (REXR), First Industrial Realty Trust, Inc. (FR), EastGroup Properties, Inc. (EGP), and Terreno Realty Corporation (TRNO) have compelling multi-year cash-flow growth runways.

Data Center REITs (11.6%): Following strong share price performance in 2023, we trimmed our exposure in data centers from 13.7% to 11.6%. We continue to believe the multi-year prospects for real estate data centers are compelling. Data center landlords such as Equinix, Inc. (EQIX) and Digital Realty Trust, Inc. (DLR) are benefiting from record low vacancy, demand outpacing supply, and rising rental rates. Regarding the demand outlook, several secular demand vectors are contributing to robust demand for data center space globally. They include outsourcing of information technology, increased cloud computing adoption, ongoing growth in mobile data and internet traffic, and artificial intelligence (AI) as a new wave of data center demand.

Wireless Tower REITs (5.8%): Please see “Top detractors” for the quarter ended March 31, 2024 for our thoughts on American Tower Corporation (AMT). We remain optimistic about the long-term growth prospects for wireless tower REITs given strong secular growth expectations for mobile data usage, 5G spectrum deployment and network investment, edge computing (possible requirement of mini data centers next to a tower presents an additional revenue opportunity), and connected homes and cars, which will require increased wireless bandwidth and increased spending by the mobile carriers.

Life Science REITs (0.6%): Alexandria Real Estate Equities, Inc. (ARE) is the life science industry leader and sole publicly traded life science pure-play REIT. In the most recent quarter, we reduced our position in the company and reallocated the capital to other companies that we believe have superior near-term return potential. We may revisit Alexandria at a later date because we believe investor concerns about competitive supply and distress related to some of REIT’s biotechnology and health care tenants are overblown and sufficiently discounted. We believe the management team has assembled a desirable real estate portfolio, enjoys a leading market share position in its geographic markets, and has solid expectations for long- term demand-driven growth.

Short-lease duration REITs (27.0% of the Fund’s net assets)

Single-Family Rental REITs (9.0%): In the most recent quarter, we modestly increased our investments in single-family rental REITs Invitation Homes, Inc. (INVH) and American Homes 4 Rent (AMH).

Demand conditions for rental homes are attractive due to the sharp decline in home affordability; the propensity to rent in order to avoid mortgage down payments, avoid higher monthly mortgage costs, and maintain flexibility; and the stronger demand for home rentals in the suburbs rather than apartment rentals in cities. Rising construction costs are limiting the supply of single-family rental homes in the U.S. housing market. This limited inventory combined with strong demand is leading to robust rent growth.

Both Invitation Homes and American Homes 4 Rent have an opportunity to partially offset the impact of inflation given that their in-place annual leases are significantly below market rents. Valuations are compelling at mid-5% capitalization rates, and we believe the shares are currently valued at a discount to our assessment of net asset value.

We remain mindful that expense headwinds and slower top-line growth could weigh on growth in 2024. We will continue to closely monitor business developments and will adjust our exposures accordingly.

Multi-Family REITs (8.8%): In the months ahead, we are cognizant that multi-family REITs may face moderating demand and rent growth in part due to the possibility of accelerating job losses in certain geographic markets. Further, reports of elevated multi-family supply and select private market distress may weigh on multi-family shares, though a portion of these headwinds are, in our opinion, already reflected in share prices and public valuations.

We remain long-term bullish on multi-family REITs and may look for an opportunity to increase our exposure at some point in 2024 or 2025. Rental apartments continue to benefit from the current homeownership affordability challenges. Multi-family REITs provide partial inflation protection to offset rising costs due to leases that can be reset at higher rents, in some cases, annually. We believe the supply outlook is likely to be attractive in 2025 to 2027. Balance sheets are well capitalized with low leverage thereby positioning certain multi-family REITs to take advantage of M&A opportunities should they arise.

Hotel REITs (4.1%): We are long-term bullish about the prospects for hotel REITs and other travel-related real estate companies. Several factors are likely to contribute to multi-year tailwinds including a favorable shift in consumer preferences, a growing middle class, and other encouraging demographic trends. Even though travel-related business conditions may moderate in the year ahead, which would negatively impact leisure spending and business travel, we maintain an allocation to select travel-related real estate because we believe the long-term investment case for travel is compelling.

In the most recent quarter, we initiated a position in Park Hotels & Resorts Inc. (PK). Please see “Top net purchases” for an explanation of our rationale for acquiring shares in the company.

We maintained our position in DiamondRock Hospitality Company (DRH) during the first quarter. DiamondRock owns high-quality hotel assets skewed towards resort and leisure. We believe the value of the company’s irreplaceable leisure-focused portfolio the company has curated over the past 20 years will ultimately be realized either in the public or private markets. There is a significant amount of undeployed private equity capital on the sidelines geared toward the exact types of assets that DiamondRock owns. Shares remained attractively valued both on a relative and absolute basis with the company being conservatively capitalized relative to its peers and with no near-term debt maturities.

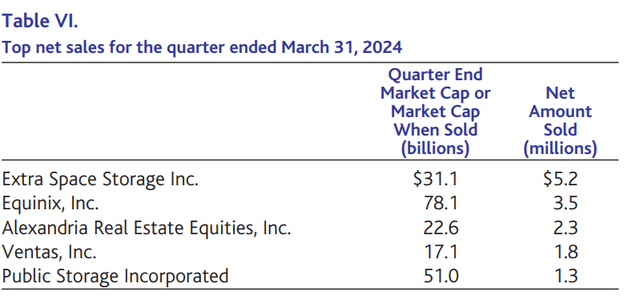

Self-Storage REITs (2.7%): In the most recent quarter, we reduced our position in self-storage REITs – Extra Space Storage Inc. (EXR) and Public Storage Incorporated (PSA) – due to our expectation of underwhelming customer demand that we expect will continue to weigh on occupancy and rents.

Long term, we believe there is a lot to like about self-storage businesses. Existing customers continue to perform well with strong high single-digit to double-digit existing customer rate increases. Monthly leases provide an opportunity for landlords to increase rents and combat inflation. Self-storage facilities do not tend to require significant ongoing capital expenditures. Elevated construction costs are constraining new construction. Should economic growth continue to decelerate and perhaps lead to a recession, self-storage business fundamentals have historically held up well during economic downturns.

Manufactured Housing REITs (2.4%): We have maintained our position in Sun Communities, Inc. (SUI) because demand for the company’s core business (manufactured housing, RVs, and marinas) remains strong, we believe the shares are attractively valued, and we have a favorable view of CEO Gary Shiffman whose interests are aligned given his significant investment in the company.

Manufactured housing REITs Sun Communities and Equity Lifestyle Properties, Inc. represent a niche real estate category that we expect to benefit from favorable long-term demand/supply dynamics. The companies are beneficiaries of strong demand from budget-conscious home buyers such as retirees and millennials, and negligible new inventory due to high development barriers. Sun Communities and Equity Lifestyle Properties have solid long-term cash-flow growth prospects and lower capital expenditure requirements than a number of other REIT categories.

Other REIT and non-REIT real estate investments (36.8% of the Fund’s net assets)

Health Care REITs (7.5%): We remain optimistic about our health care REIT investment in Welltower Inc. (WELL) largely due to our favorable view of the multi-year prospects for senior housing. We believe senior housing real estate is likely to benefit from favorable cyclical and secular growth opportunities in the next few years. Fundamentals are improving (rent increases and occupancy gains) against a backdrop of muted supply growth due to increasing financing and construction costs and supply-chain challenges. The long-term demand outlook is favorable, driven in part by an aging population (baby boomers and the growth of the 80-plus population), which is expected to accelerate in the years ahead. Expense pressures (labor shortages/other costs) are abating, and we believe highly accretive acquisition opportunities may surface, particularly for Welltower given its cost of capital advantage.

Mall REITs (7.1%): In the most recent quarter, we increased our exposure to mall REITs with our purchase of The Macerich Company (MAC). Please see “Top net purchases” for our more complete thoughts on Macerich. Simon Property Group, Inc. (SPG) is our other notable position in the category. Please see “Top contributors” for our thoughts on Simon.

We believe our mall REITS are attractively valued and that their portfolio companies are benefiting from strong tenant demand for space, positive rent growth, and limited store closures and bankruptcies.

Office REITs (0.2%): The Fund has maintained a modest position in Boston Properties, Inc. (BXP), an owner of high-quality office buildings.

Non-REIT Real Estate Companies (22.1%): We emphasize REITs but have the flexibility to invest in non-REIT real estate companies. We tend to limit these to no more than 20% to 25% of the Fund’s net assets. At times, some of our non-REIT real estate holdings may present superior growth, dividend, valuation, and share price appreciation potential than some REITs.

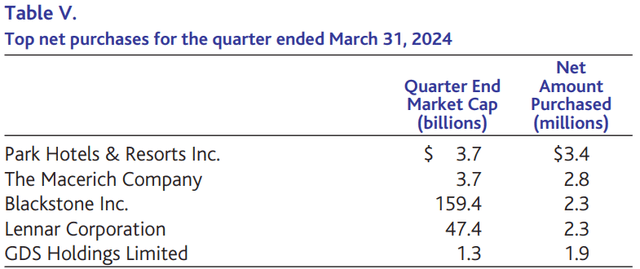

In the first quarter, we were active in acquiring shares in additional non-REIT real estate companies (Blackstone Inc. (BX), Lennar Corporation (LEN), GDS Holdings Limited (GDS)(OTCPK:GDHLF), Tri Pointe Homes, Inc. (TPH), and Hilton Worldwide Holdings Inc. (HLT)). We remain bullish about the prospects for our other non-REIT real estate investments, which in addition to the above include: Toll Brothers, Inc. (TOL), Wynn Resorts, Limited (WYNN), Brookfield Asset Management Ltd. (BAM), Brookfield Corporation (BN), Lowe’s Companies, Inc. (LOW), Brookfield Infrastructure Corporation (BIPC), and Marriott Vacations Worldwide Corporation (VAC).

Top Contributors And Detractors To Performance

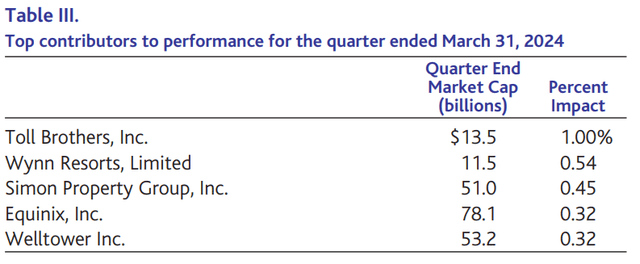

Following exceptional performance in 2023, the share price of Toll Brothers, Inc. continued to move higher in the first quarter of 2024, gaining 26.0%, in part due to the continuation of strong quarterly business results and management optimism about the company’s multi-year prospects.

In March, we traveled to Pennsylvania to meet with Doug Yearley and other key members of Toll Brothers’ senior management team. Our broad-ranging discussion strengthened our view that the long-term prospects for Toll Brothers have never been brighter. Our optimism is due to several factors including:

- Strong long-term growth prospects: In the next few years, we believe Toll Brothers has the ability to grow its community count of homes by approximately 10% per annum due to its multi-year supply of highly desirable land and the possibility of additional land or builder acquisitions.

- Limited competition: Toll Brothers has established itself as the dominant luxury homebuilder in the U.S. with few competitors. Toll Brothers’ average home sale price is approximately $1 million per home. Most public homebuilders sell homes in the $400,000 to $550,000 range. Toll Brothers’ main competitors are small private homebuilders who are competitively disadvantaged due to the company’s brand, scale, and balance sheet advantages.

- Large addressable and growing market: According to Toll Brothers, the size of its U.S. addressable market to sell its homes is approximately 16 million households with annual incomes of at least $200,000 (out of a total of 132 million households). In 2023, Toll Brothers sold approximately 10,000 homes or only 0.06% of its total addressable market. Given Toll Brothers’ limited competition and several other attributes noted below, we believe the company is just scratching the surface of its potential to increase its market share dramatically over time. Further, Toll Brothers targets the fastest growing income demographic in the U.S., which also bodes well for the company’s long-term growth prospects. According to the U.S. Census Bureau (September 2023), households with over $200,000 in annual income have grown approximately 10 times faster than all U.S. households in the last 10 years.

Additional factors that support our long-term optimism for Toll Brothers include:

- The company’s prestigious land locations

- Toll Brothers’ build-to-order model that caters to the needs of many buyers who have the desire and means to personalize their homes

- Its strong home buyer profile-in its most recent quarter, approximately 25% of its buyers bought homes with cash and no mortgage

- Toll Brothers’ competitively advantaged balance sheet (low leverage, zero debt maturities until 2026, $2.5 billion of liquidity)

- The company’s commitment to deploy its operating cash flow prudently towards growth, returning capital to shareholders (since 2016, Toll Brothers has repurchased almost 50% of its outstanding shares), and reducing debt

- Our belief that Toll Brothers, over the long term, will generate among the strongest profitability margins and return on equity profiles of all homebuilders

- A deep and talented management team, led by CEO Doug Yearley

- The valuation of Toll Brothers-currently at only 9.4 times 2024 estimated earnings per share-may re-rate higher over time

The shares of Wynn Resorts, Limited, an owner and operator of hotels and casino resorts, increased 12.4% in the first quarter following strong quarterly results.

We remain optimistic about the multi-year prospects for Wynn. We believe the ongoing re-emergence of business activity in Macau will drive additional shareholder value. If cash flow returns to the level achieved in 2019 prior to COVID-19, we believe Wynn’s shares will increase 30% to 50% from where they have recently traded.

We believe additional drivers for future value creation beyond a re-emergence in Macau business activity include: (i) our expectation for long-term growth opportunities in the company’s U.S.-centric markets of Las Vegas and Boston, including an expansion of Wynn’s Encore Boston Harbor resort; (ii) Wynn’s plans to develop an integrated resort in the United Arab Emirates with 1,500 hotel rooms and a casino that is similar in size to that of Encore Boston Harbor; (iii) opportunities to improve cash-flow margins by rightsizing labor and achieving lower staff costs in Macau; the possibility that Wynn is granted a New York casino license; and an expansion in the company’s valuation multiple to levels achieved prior to the pandemic.

The shares of Simon Property Group, Inc., the largest U.S. mall and outlet REIT, appreciated by 11.1% during the most recent quarter, partly driven by continued strong fundamentals for its high-quality malls and outlet real estate.

The company has assembled a well-located portfolio of retail malls, outlets, and community centers. Simon’s size and access to capital are distinct advantages in the retail real estate industry. Led by CEO David Simon, its management team has a long track record of solid capital allocation decisions, while managing its portfolio especially well. Over time, we believe the company may continue to acquire Class A malls.

The fundamental backdrop for high-quality mall and outlet real estate remains favorable. Tenant demand remains robust, as a broad-based group of retailers seek to secure space to meet their 5- to 10-year growth objectives. In the meantime, there is a shortage of desirable space that is available, since industry occupancy is high, and limited new mall and outlet developments are underway. This demand/supply imbalance is enabling landlords like Simon to raise rents.

We think Simon has opportunities to increase occupancy and rents and acquire new properties and assets at attractive prices relative to the company’s cost of capital, while growing the company’s attractive 5.0% dividend.

We believe Simon’s valuation is compelling at less than 13 times earnings (FFO) versus a long-term average of 15 times earnings.

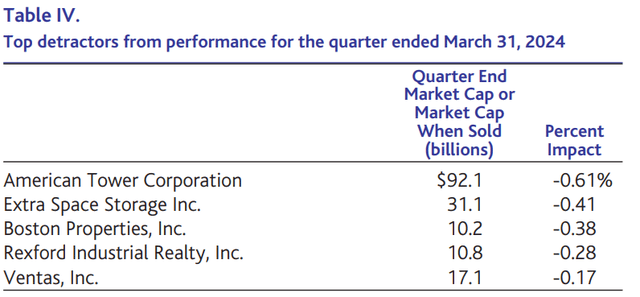

Following a significant 30% rebound in the fourth quarter of 2023, shares of American Tower Corporation lagged in the first quarter of 2024. We believe the uncertainty around the timing and ultimate financial impact of American Tower’s India business sale and the ongoing lower overall spending by wireless carriers weighed on shares.

We continue to be optimistic about American Tower’s long-term growth prospects due to: i) reaccelerating earnings growth after a trough in 2023; ii) its stellar management team with a strong track record of capital allocation; iii) cash flow stability underpinned by core developed markets; iv) secular demand drivers such as growth in mobile data usage, 5G spectrum deployment and network investment, edge computing, and connected homes and cars; and iv) strong growth within CoreSite, its network-dense data center company, and optionality with that business segment as future network needs and architecture evolve. We believe American Tower’s shares are attractively valued relative to its history and several other REIT alternatives.

The shares of Extra Space Storage Inc., a best-in-class self-storage REIT, and Boston Properties, Inc., an owner of high-quality office buildings, declined in the first quarter due to disappointing growth prospects for 2024. Though we hold both companies in high regard, we continue to monitor our exposure to Extra Space and Boston Properties and may continue to trim and reallocate proceeds to other real estate companies that we believe may offer superior total return prospects.

Recent Activity

In the first quarter, we met with the management team of Park Hotels & Resorts Inc. and initiated a position in the company. Park Hotels owns 43 hotels with 26,000 rooms across the U.S. with an outsized presence in Hawaii, which represents approximately one-third of its cash flow.

We believe the total return prospects for Park Hotels remain compelling due to: i) attractive valuation with shares trading at a meaningful discount to peers, underlying replacement cost and market value of its assets; ii) enhanced cash flow realization from its recently completed large renovation projects that will contribute outsized growth; iii) a diverse set of demand drivers across group, business transient, and leisure with group recovery in full swing; iv) outsized exposure to the attractive Hawaiian market, with a mid-priced offering, where Japanese travelers (a key demand driver) still remain 80% below pre-COVID levels; v) an improved balance sheet and portfolio mix after its exit of two large San Francisco assets; and vi) the company’s attractive high single-digit dividend yield.

We initiated a position in The Macerich Company during the most recent quarter. Macerich is a REIT that owns a portfolio of 43 exceptionally high- quality malls in the U.S., with key states that include California, New York, and Arizona.

We are excited about the medium-term prospects for Macerich for four reasons:

- The fundamental backdrop for high-quality mall real estate remains favorable. Tenant demand remains robust, as a broad-based group of retailers seek to secure space to meet their 5- to 10-year growth objectives. In the meantime, there is a shortage of desirable space that is available, since industry occupancy is high and no new mall developments are underway. This demand/supply imbalance is enabling landlords to raise rents.

- Macerich owns an exceptionally high-quality portfolio of mall real estate. Approximately 90% of the company’s portfolio value is derived from malls graded Class A, which means the properties are well located, highly productive, and appealing to prospective tenants.

- We see continued growth opportunities for Macerich through increases in occupancy, rents, margins, and redevelopment projects, which should lead to continued cash flow growth.

- CEO transition is underway for the first time in decades. Effective March 1, 2024, Jackson Hsieh became President and CEO of Macerich. Jackson most recently served as CEO of net lease REIT Spirit Realty Capital until its acquisition by Realty Income in January 2024. At Spirit, Jackson led a successful turnaround effort to improve overall portfolio quality and simplify the capital structure. We believe Jackson has an opportunity to make similar improvements at Macerich, including selling non-core properties and repaying debt (debt levels are presently elevated).

At the current share price, we believe Macerich is valued at a significant discount relative to its closest publicly traded mall peers and relative to recent mall transactions that have taken place in the private market. We anticipate that this valuation discount may narrow or close in the coming years as the turnaround plan progresses.

We added to our position in Blackstone Inc., the largest real estate manager in the world with an impressive investment track record and $1 trillion of total assets under management. We believe Blackstone is a true best-in-class company. It has a premier brand, a global franchise, loyal customers, and substantial insider ownership. Blackstone is fast-growing, manages its business in an asset-light manner with limited needs for capital, produces high cash-flow margins, is anchored by a recurring revenue base, and is able to return nearly 100% of its cash flow through an attractive dividend yield and share repurchases. While its base business continues to thrive, we believe Blackstone is only in the very early stages of penetrating the $80 trillion private wealth opportunity that remains largely untapped and think Blackstone is best positioned to capture outsized market share due to the attributes listed above, including its strong brand name. Lastly, the company is led by its exceptional CEO Stephen Schwarzman and President Jon Gray and it attracts and retains top talent. We believe Blackstone is exceptionally positioned to continue to increase its market share in this secular growth opportunity for alternative assets.

In the most recent quarter, we reduced our holdings in Extra Space Storage Inc., a best-in-class self-storage REIT, and Alexandria Real Estate Equities, Inc., a leading developer and owner of life sciences real estate, and reallocated the capital to other REITs that we believe may generate superior total returns.

Following strong share price performance in 2023, we reduced our large position in Equinix, Inc., the premier global operator of network-dense, carrier-neutral colocation data centers with operations across 32 countries. We remain optimistic about the company’s long-term prospects. We believe the underlying demand vectors, strong pricing power, favorable supply backdrop, and interconnection focus will support approximately 10% cash- flow-per-share growth for the next several years with upside from further scaling of digital services, incremental AI demand, and select M&A opportunities.

Concluding Thoughts On The Prospects For Real Estate And The Fund

The last few years have been unusually challenging for real estate. The sector has absorbed a hurricane of headwinds including COVID-19, the most aggressive Fed interest rate tightening campaign in decades, a spike in mortgage rates from 3% to 8%, fears of a commercial real estate crisis, a tightening of credit availability, multi-decade high inflation, and supply- chain challenges.

We believe many of the challenges of the last few years are subsiding. We believe brighter prospects for real estate are on the horizon. We are optimistic.

We continue to believe the narrative about a commercial real estate crisis is hyperbole and unlikely to materialize. Public real estate generally enjoys favorable demand versus supply prospects, maintains conservatively capitalized balance sheets, and has access to credit.

We believe we have assembled a portfolio of best-in-class competitively advantaged REITs and non-REIT real estate companies with compelling long- term growth and share price appreciation potential. We have structured the Fund to capitalize on high-conviction investment themes. Valuations and return prospects are attractive.

We believe our approach to investing in REITs and non-REIT real estate companies will shine even brighter in the years ahead, in part due to the rapidly changing real estate landscape which, in our opinion, requires more discerning analysis.

For these reasons, we remain positive on the outlook for the Fund.

I would like to thank our core real estate team – assistant portfolio manager David Kirshenbaum, George Taras, David Baron, and David Berk – for their outstanding work, dedication, and partnership.

I, and our team, remain fully committed to doing our best to deliver outstanding long-term results, and I proudly continue as a major shareholder, alongside you.

Sincerely,

Jeffrey Kolitch, Portfolio Manager

|

Investors should consider the investment objectives, risks, and charges and expenses of the investment carefully before investing. The prospectus and summary prospectus contain this and other information about the Funds. You may obtain them from the Funds’ distributor, Baron Capital, Inc., by calling 1-800-99-BARON or visiting Baron Funds – Asset Management for Growth Equity Investments. Please read them carefully before investing. Risks: In addition to general market conditions, the value of the Fund will be affected by the strength of the real estate markets as well as by interest rate fluctuations, credit risk, environmental issues and economic conditions. The Fund invests in debt securities which are affected by changes in prevailing interest rates and the perceived credit quality of the issuer. The Fund invests in companies of all sizes, including small and medium sized companies whose securities may be thinly traded and more difficult to sell during market downturns. The Fund may not achieve its objectives. Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk. Discussions of the companies herein are not intended as advice to any person regarding the advisability of investing in any particular security. The views expressed in this report reflect those of the respective portfolio managers only through the end of the period stated in this report. The portfolio manager’s views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time based on market and other conditions and Baron has no obligation to update them. This report does not constitute an offer to sell or a solicitation of any offer to buy securities of Baron Real Estate Income Fund by anyone in any jurisdiction where it would be unlawful under the laws of that jurisdiction to make such an offer or solicitation. The portfolio manager defines ” Best-in-class” as well-managed, competitively advantaged, faster growing companies with higher margins and returns on invested capital and lower leverage that are leaders in their respective markets. Note that this statement represents the manager’s opinion and is not based on a third-party ranking. BAMCO, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission (SEC). Baron Capital, Inc. is a broker-dealer registered with the SEC and member of the Financial Industry Regulatory Authority, Inc. (FINRA). |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.