Nearly seven out of 10 metro markets registered home price gains in the first quarter of the year, according to the National Association of Realtors. Seven percent of the 221 tracked metro areas registered double-digit price increases, down from 18 percent in the fourth quarter of 2022.

Compared to a year ago, the national median single-family existing-home price decreased 0.2 percent to $371,200. In the previous quarter, the year-over-year national median price increased 4 percent.

The South saw the largest share of single-family existing-home sales—46 percent—in the first quarter, with year-over-year price appreciation of 1.4 percent.

“Generally speaking, home prices are lower in expensive markets and higher in affordable markets, implying greater mortgage rate sensitivity for high-priced homes,” said NAR Chief Economist Lawrence Yun. “Home prices are also lower in cities that previously experienced rapid price gains,” Yun added. “For example, home prices grew an astonishing 67 percent in three years in Boise City and Austin through 2022. The latest price reductions in these areas have improved housing affordability and led to some buyers returning given the sustained, rapid job creation in their respective markets.”

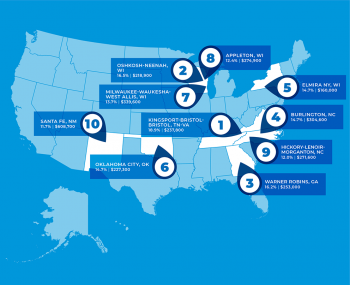

The top 10 metro areas with the largest year-over-year price increases all recorded gains of at least 11.7 percent. Those markets include: Kingsport-Bristol-Bristol, TN; Oshkosh-Neenah, WI; Warner Robins, GA; Burlington, NC; Elmira, NY; Oklahoma City; Milwaukee; Appleton, WI; Hickory-Lenoir-Morganton, NC; and Santa Fe.

Seven of the top 10 most expensive markets in the U.S. were in California, including San Jose, Anaheim, San Francisco, San Diego; Salinas; San Luis Obispo, and Oxnard-Thousand Oaks-Ventura.

This post was originally published on this site be sure to check out more of their content.