O’Connor conducted a study finding modest gains in commercial and residential property values during McLennan County’s 2024 tax reassessment.

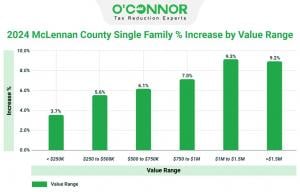

WACO , TEXAS , UNITED STATES , June 26, 2024 /EINPresswire.com/ — Higher Property Value Homes Experienced a 5.5% Increase

In 2024, McLennan County’s property values showed a consistent upward trend across various price ranges. Homes valued below $250K saw a 3.7% increase, while those between $250K to $500K experienced a 5.6% rise. The pattern continued with higher value ranges, with homes priced over $1.5 million showing a notable 9.3% increase, contributing to an overall 5.5% growth in total property values for the county.

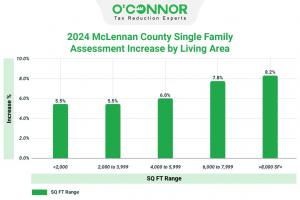

McLennan County’s property values demonstrated a consistent increase across various square footage ranges in 2024. Homes with less than 2,000 square feet and those between 2,000 to 3,999 square feet both experienced a 5.5% rise. Larger properties also saw significant growth, with those between 6,000 to 7,999 square feet and over 8,000 square feet showing increases of 7.8% and 8.2%.

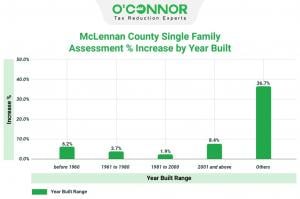

Percentage Increase for Single-Family Home Assessments Based on Year of Construction

McLennan County’s single-family properties built between 1961 and 1980 experienced the lowest rise at 3.7%. However, the category labeled “Others”, representing properties without a specific construction year showed the highest increase of all with a 36.7% rise. While this is an enormous increase, this segment of properties only accounts for 0.08% of McLennan’s residential properties by value, and the omission of the year of construction may be more frequently observed for properties where construction is recent. In this situation, a staggering increase such as this may be attributed to the fact that the previous year value was based on land without improvements and the reassessment includes a newly built structure.

Among the total accounts assessed, 2,008 houses were deemed overvalued, representing a 55% increase. In contrast, 1,624 houses valued at or below market value accounted for a lower increase, totaling a 45% rise from the 2023 sales price.

Property Values for Hotel Buildings in McLennan County Saw a Significant Increase In 2024

The reported data reveals that commercial property assessments in McLennan County exhibited variations by property type in 2024. Apartments saw a decline of 1.3%, while warehouses and hotels showed more significant increases at 11.1% and 16.3%. Overall, the county property owners witnessed a 4.0% rise in total commercial property assessments.

The McLennan Central Appraisal District observed moderate increases in commercial property assessments across McLennan County in 2024 across all construction timeframes. Buildings built prior to 1960 experienced a 3.9% uptick, while those constructed between 1961 and 1980, as well as between 1981 and 2000, saw comparable 4.0% increments. Properties constructed from 2001 onwards demonstrated the most substantial rise at 5.3%.

McLennan CAD’s commercial valuations increased by 4%, as reported by the WSJ

Green Street Real Estate found a significant gap in the 2024 reassessment by the McLennan Central Appraisal District. While the district reports a 4% rise in commercial property prices, Green Street’s study shows a 21% drop in property values nationwide since March 2022. This suggests challenges in assessing true market value in McLennan County.

Significant Rise in Higher-Valued Properties

The recent data from the McLennan CAD indicates a 1.2% increase in commercial properties valued below $500K, a considerable 5.3% uptick for properties in the $500K to $1M range, and a notable 5.5% rise for properties valued between $1M to $5M. These trends collectively contribute to an overall 4.0% growth in commercial property values.

McLennan County Apartment Property Values Rise By 15.7%

In 2024, property tax assessments for apartment complexes in McLennan County experienced a decline of approximately 1.3%. Notably, there was a 1.3% increase in the value of apartment complexes built before 1960. However, the remaining buildings, constructed more recently, either saw declines or minimal increases in value.

McLennan County’s Office Buildings Seen Modest Rises in Property Values

According to the McLennan Central Appraisal District, office buildings constructed between 1961 and 1980 experienced a notable 7% rise in property tax assessments. Similarly, commercial offices built between 1981 and 2000 saw an increase of 5.4%. Overall, there was a cumulative increase of around 4% for office buildings across all construction years.

Retail Properties Constructed Before 1960 Experience Growth

Retail property values in McLennan County have risen, averaging a 5.4% increase. Particularly noteworthy is the remarkable growth observed in retail buildings constructed before 1960, with their value surging from $133 million in 2023 to $145 million in 2024, marking an 8.7% increase. In contrast, retail buildings developed after 2001 experienced the lowest decline, with a 3.3% increase from the previous year.

Warehouse constructions post-2001 experienced the most notable surge in worth, boasting an impressive 14.4% uptick. Conversely, those built between 1981 and 2000 were valued the least, seeing only a 6.5% rise in appraised market value.

High Rise Office Buildings See a 6% Increase in 2024 Reassessment

High rise office buildings saw a growth rate, surging by 6%, whereas medical office buildings witnessed a more modest gain of 1.8%. Overall, the assessments for 2024 increased by almost 4%.

Apartment Buildings Experienced a 1.3% Decrease

In 2024, property tax assessments for different types of apartment buildings in McLennan County collectively seen a decrease of 1.3%.

Strip Center Retail Building in McLennan County Seen 6.3% Property Tax Increase in 2024

In 2024, strip center buildings in McLennan County experienced a 6.3% spike in property taxes, whereas the value of mall retail buildings remained stagnant compared to 2023.

Mini Warehouse Revaluations Drive Significant Increases Across Warehouse Types in McLennan County

Market values for warehouse facilities within the McLennan Central Appraisal District rose by 11% overall. Notably, mini warehouse buildings saw a notable surge of 24%, escalating from $165 million to $205 million. Conversely, the metal warehouse category experienced a more modest increase of approximately 3.7% in property values.

McLennan Central Appraisal District 2024 Property Tax Revaluation Assessment Overview

McLennan County property owners have witnessed a marginal increase in both commercial and residential property prices, surpassing the documented expansion observed in the Waco metropolitan area.

Despite substantial profits in the commercial real estate sector, certain market dynamics have posed challenges for some and proved disadvantageous for others. Privately, some homeowners have acknowledged a decrease in the value of their residential properties in recent years. This decline can largely be attributed to the surge in interest rates, which escalated from 1.71% in January 2022 to 4.05% in January 2024. Moreover, consistent income patterns, along with significant and continuous rises in casualty insurance and other operating costs, have compounded this predicament.

Regularly Review Property Values Each Year to Maximize Potential Savings

In Texas, particularly in McLennan County, property owners have the legal right and would be wise to challenge the assessed value of their land. During the appeals process, both residential and commercial property owners have the opportunity to present evidence supporting their claim of an excessively high assessment. It is advisable to initiate an appeal or seek assistance from a property tax consulting firm, as many protests result in favorable outcomes.

With over 50 years of experience, O’Connor is highly skilled in advocating for property owners in disputes related to both residential and commercial properties. Moreover, O’Connor possesses the necessary resources to effectively achieve their primary objective of enhancing the lives of property owners by reducing taxes to a fair and justifiable extent.

About O’Connor

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 900 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O’Connor, President

O’Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube

![]()

This post was originally published on this site be sure to check out more of their content.